This time, I would like to share my income tax saving strategy this year 2021 in Thailand. If you are working as employee in Thailand, your company deducts income tax from your monthly salary then pay to revenue office. This article gives you the tips how to save such income tax amount legally.

Tax saving for FIRE

As you know, I am now aiming for FIRE in Thailand. FIRE means “Financial Independence and Retire Early” which is prevailed lifestyle fad especially amongst younger generation. Please read my introductory post below to get to know my life plan and what is FIRE. FIRE can be achieved by saving daily cost of living then invest spare money so that your money can work by themselves to produce extra profit to cover your life cost in future.

To achieve FIRE in Thailand, it is well required to keep living cost as low as possible and invest the surplus money to index fund so that the accumulated fund amount can yield the money to spend daily lives. By saving income tax then invest saved amount so I can accelerate the speed to achieve FIRE in near future.

There are several ways to get refund of income tax in Thailand. What I am mainly focusing on and one of major ways is to purchase financial products from banks and insurance companies. I will explain my tax saving strategy in this year by buying financial products in Thailand.

Time line of income tax saving

Here is the time line procedure to save income tax (get refund of tax) for 2021 salary income.

- Jan – Dec, 2021 – Purchase financial products, make donation etc, to be eligible for tax refund.

- Jan – Mar, 2022 – Collect all necessary documents for tax deductibles then request refund to Thai revenue department.

So throughout 2021, I save money as much as possible then allocate to purchase financial products such as mutual fund and life insurance. Once 2021 year payroll is closed, I will receive 50 Tewi form from the company for tax refund process (50 tewi is same as W2 form in US, the document states the your salary and deduction in one year). Together with 50 tewi, I will also collect documents from banks and insurance company to prove the purchase of its financial products then submit tax refund request either online or tax office nearby your residence.

To process tax refund request, please read my past article. Annual process is not that much changed each year so you can still refer to my post below

General rules of Income tax in Thailand

If you are working like me in Thailand legally by obtaining work permit, you are of course, required to pay tax. Normally your company deducts income tax then pay based on your expected annual salary. Once tax year is closed, everyone must declare income then adjust the tax amount at this time. (Tax year in Thailand is from Jan – Dec. )

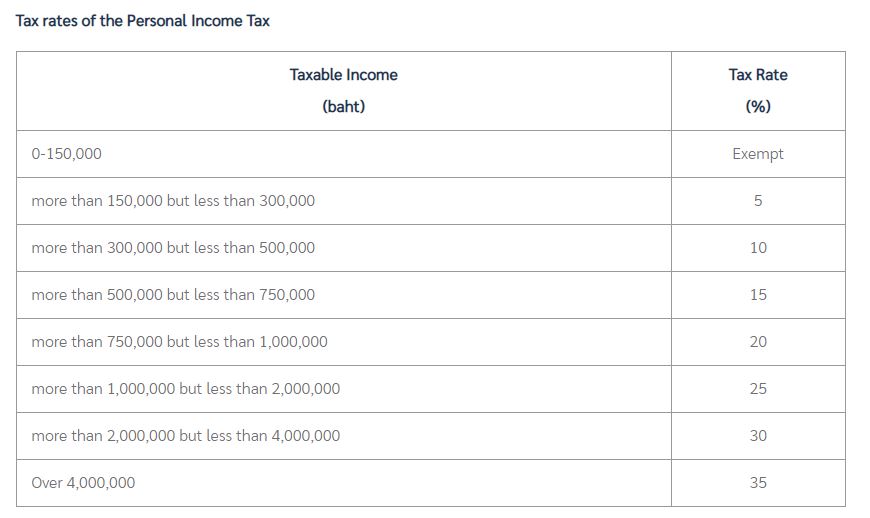

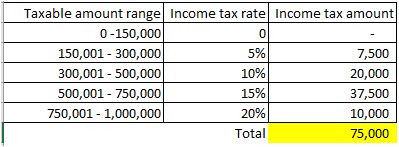

Above is the gradual taxation list in Thailand. To make calculation ease, let’s say your total taxable income is 800,000 THB. This amount is considered after the deduction of basic deductibles including social security fee. So in case, your taxable income is 800,000 THB, your income tax will be 75,000 THB as below.

For example, you spend 500,000 THB in total to purchase financial products which can be used for income deduction. Therefore you can deduct this amount 500,000 THB from my original taxable income amount 800,000 THB. Total taxable income will be changed to 300,000THB. Income tax amount for 300,000 THB is only 7,500 THB so you can get refund of 67,500 THB (75,000THB – 7,500 THB) in the following year.

This amount is quite big, I think standard one month salary amount for foreign residents in Thailand. Purchasing financial products in Thailand is not difficult as well as tax refund request process. If you are interested, please inquire your bank to support.

For details of income taxation regulation in Thailand, you can visit the website for The Revenue department.

So next I will introduce my income tax saving strategy in 2021.

1st Step: Purchase Life Insurance

First, I focus on purchase of Life insurance. Each major bank and Insurance company offers various type of products so you can inquire your bank and compare with others. At the time when I started to purchase life insurance, I used Krungsri bank mainly so I asked them if they offer such products.

Bank staff is normally welcoming this kind of inquiry because they can get incentives from successful contract case. Even more, they will give you several freebies if you make contract with them. In my case, When I made 10 year plan contract with Thai life insurance through Krungsri Bank, I got carry-on size suite case and air flyer for free. Kindly be careful that the eligible life insurance for tax refund is more than 10 years contract. Bank staff will understand this point if you tell them that you are intended to buy the products for tax saving purposes.

And why I recommend this first thing first? This is because it is safe to purchase life insurance in Thailand. the amount you purchased will be protected 100% by the Office of Insurance Commission in case of bankruptcy of banks or insurance companies.

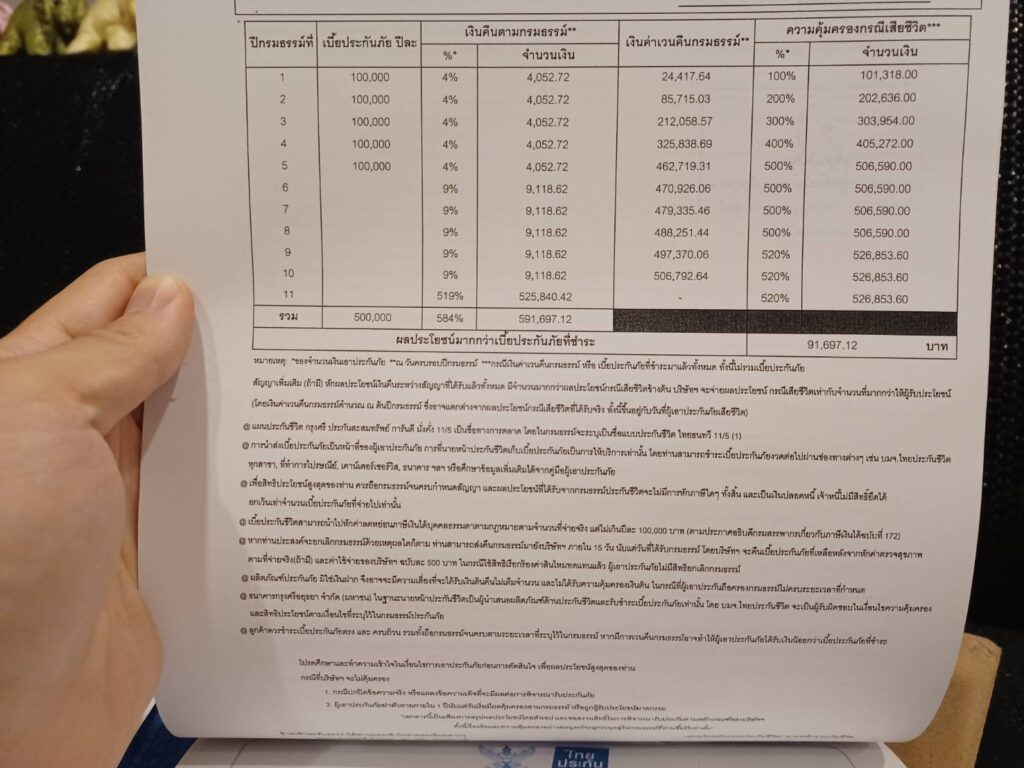

Below is my contract details with Thai Life insurance through Krungsri Bank.

According to the table, I must purchase 100,000 THB for 5 consecutive year, totally 500,000THB. Then every year I will receive the amount from Insurance company, my investment will be 591,697.12 THB in 10 years total. So that interest will be 91,697.12 THB in 10 years.

Besides, When I purchase life insurance premium 100,000 THB every year, I can deduct this 100,000 THB amount from my taxable income. It means I can request for tax refund for my taxable income 100,000 THB.

Income tax rate varies based on your total income amount but let’s say that your income tax rate is 25% to make story simple. In such hypothesis, you can receive refund 25% of 100,000 THB, which is 25,000 THB. And you can do for this 5 consecutive years as long as you continues to purchase.

So basically you pay 100,000THB for 5 years, which means total invest amount is 500,000 THB

After 10 years, you receive 591,697.12. Additionally, you will receive also tax refund 25,000 THB X 5 years = 125,000THB. To sum up, your money grows to 716,697.12 THB.

Within 10 years of holding life insurance, your money will increase by 43%.

(from 500,000 THB to 716,696.12 THB)

2nd Step: Invest to SSF “Super Saving Fund”

2nd priority for me is to invest my money to SSF “Super Saving Fund”. SSF is mutual fund that is also offered by various banks and fund companies. Unlike life insurance, mutual fund can be invested normally from 500 THB so you can start from small amount. Invest amount to SSF also can be used for deduction of taxable income up to 200,000 THB per year to save your income tax burden.

Here are the general rules for SSF. You have to hold the fund minimum 10 years to be eligible for income tax refund process. And unlike life insurance, this is fund investment so you will have chance to incur the loss always depending on market performance fluctuation. Before embarking on investment to SSF, please be well noted on this risk points.

There are numerous SSF products are introduced by My recommendation for the readers is S&P500 index fund provided by Siam Commercial Bank (SCB), product name is “SCBS&P500-SSF”

This fund is linked to S&P500 (Standard and Poor’s 500) index in US stock market. S&P500 market value will be varied based on the performance of 500 largest companies such as Apple, Amazon, Microsoft and Facebook in US stock exchange market. Investment in S&P500 fund products means that you invest to the US economy in whole. So as long as US economy grows, S&P500 index shall also be valuated more and your fund does.

For the past 30 years, S&P500 index performed very well, yielding roughly 10 percent of return per year. Things happens in next decades are uncertain but most economists and investors are anticipating to have a yearly return 4 – 5 % considering US’s dominant economic situation over the world continuing in next decades.

You can check the historical result for S&P500 in the past 30 years in below link. There were some drops in the period but in average, 10 percent profit was achieved throughout 30 years.

I also agree to the opinion that S&P500 investment will marks higher prices and produce lucrative returns in coming years. But again, please be well noted that this is fund investment so you always have a chance to get negative profit. Before embarking on investment, please consider well and manage it by your own responsibility.

3rd Step: Invest to RMF “Retirement Mutual Fund”

The 3rd and last, I will allocate rest of my investment money to purchase Retirement Mutual Fund (RMF). This is like a pension system in Thailand you can purchase certain amount every year then encash after the retirement age 55 years in Thailand. RMF also, I purchase from SCB, the product also invests into S&P500 same as my SSF.

RMF has different purchasing rule as SSF. For example, once you started to purchase, you have to purchase every year at least 5,000 THB until you reach 55 years of retirement age.

General regulation of RMF

Conclusion

This time, I introduced my income tax saving strategy in 2021 year. I hope this will help readers to get some ideas to exercise by your own way.

As I mentioned, I aim for FIRE, early retirement before reaching 40 years old. To achieve FIRE, there are 2 keys save the cost and invest more to let money makes money. By practicing income tax saving, I can get more source then allocate to investment so I can attain my goal FIRE.

I will update my activity more for FIRE in this blog so please check it out! And I hope it will help your life strategy also.

See you!

Comment