Welcome back to my blog!, Today, I would like to explain how to declare your income tax online. If you are working in Thailand and you pay income tax every month same as me, you need to file a tax declaration form. This process is mandatory for all people, either Thai or foreigners in Thailand As long as you have source of income in Thailand, you must do it.

Submission Deadline

Document to prepare

- Por Ngor Dor1

- Pay slip in tax year

- Proof for income tax deduction (if any.)

Online submission process.

Access Revenue Department website

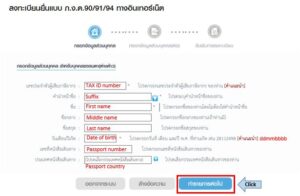

Register and Login

As you input each item, you will know that the pull down choice for suffix is all in English but country is all Thai so you have select your country in Thai not in English…. Why Thai government! LOL. For this, please google your country name in Thai then copy and paste Thai county name in the field on website so you can select your country in Thai. After completing all input, click next page.

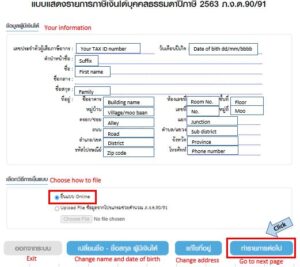

Once you complete registration, please login into the application page.

Check registered information

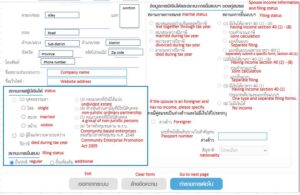

Input marital status

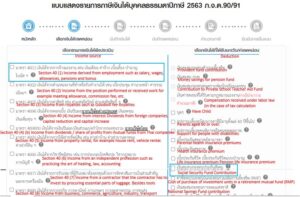

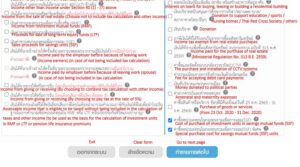

Input of type of income and deduction

In this page, you are required to input your source of income and deduction. If you are working in a company then not participating in any program or products that can be used for income tax deduction, you can just click “Income from employment” (top) in income source and Social security fund contribution in deduction side. In addition, your company might provide provident fund program to the employee. In such case, you better click on “Provident fund” (top) in deduction section.

In my case, I purchased Life insurance, SSF and SSFX in 2020 and and purchased some goods with VAT so I also click “Purchase of goods or services (from 23 Oct. 2020 – 31 Dec. 2020)” which is the program that Thai government practiced end of 2020. Up to 30,000 THB purchase of products and service during above period, purchased amount can be used for income tax deduction. Thai government sometimes enforces such law to promote general consumption. To apply for deduction, you will be in need of TAX invoice document from store or service provider to submit as proof.

Input information of “Por Ngor Dor1”

In this page, you are required to input your Income and withholding tax and your company’s TAX ID number from “Por Ngor Dor1”. After inputting all information, system will calculate the balance after expense deduction (up to 100,000THB) and you and your family’s basic deduction.

Input amount for income tax deduction

This is last input section, you are asked to input the amount for tax income deduction. Screen shows items that I selected in the application. With completion of all amount input, system will show total of income tax deduction amount at the bottom. Once finished, please go to next page.

Confirm refund/additional payment amount

Based on all information you input in the application process, system shall calculate the adjustment amount in “No.20” above. If “over pay” you can request refund for the amount, while if the result shows “additional pay”, you need to pay income tax additionally.

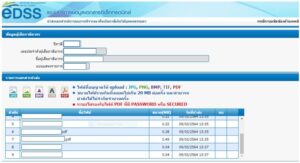

Attach the documents

In last page, you also need to submit the document, Por Ngor Dor1 and the evidences for income tax deduction.

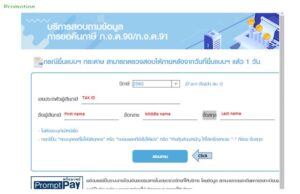

Check application status

Once you successfully submitted application, you can check the application status by below link.

Comment