Welcome back to “fitravelife.com”. In last article, I explained how to declare withholding tax by online. This time, I would like to show you how to get refund in case you are entitled.

Receive letter from the Revenue department.

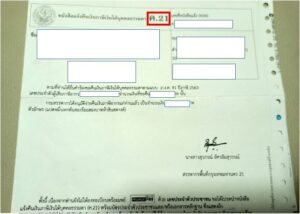

After your online submission is reviewed by the authority, you will receive letter “Kor. 21”. It took around one week in my case.

Going to bank for refund process.

Once you received letter, you can go to any branch of Krungthai bank only with documents below.

What to bring

- Letter (Kor. 21) from Revenue department

- Passport

- work permit

- Tax ID card

In case you need to pay additional tax with letter from the government, you can go to any bank to pay tax. 2 years ago, I had to pay 2,000THB additional so I went to Kasikorn bank then proceeded payment.

Receive refund.

This time, I went to Krungthai bank for my refund process. At bank, I was offered two different ways as below. Krungthai bank is not so familiar to foreigners like me but it is always crowded with Thai nationals because this bank is supported by government, more than 50% share held by the ministry of Finance, and government provides financial service and support to Thai nationals through this bank.

- Receive refund by opening bank account.

- Receive refund by E-Money card.

I chose No.2 this time since I didn’t want to have bank account not necessary actually. Besides, you need initial deposit for opening account. Opening bank account in Krungthai might be useful especially for those who want to live here for long on purpose of national pension or other fund investment.

Back to my process, I chose E-money card this time. Counter staff required me to sign some documents to issue new card for me. Whole process took around 30 minutes only.

E-Money card

Get refund by ATM.

With E-money card, you can process refund by ATM. For first time user, you need to set up pin code. Default pin code is set as “111111” then withdraw money from ATM by increment of 20,000THB. If you want to get the amount less than 100THB, you can ask counter staff to process.

OK, that’s all for refund processing. In next article, I will also explain my income tax deduction plan for this year so you can refer and get some ideas for your own plan.

My refund amount for last year’s income tax is more than one month salary so I highly recommend that the readers consider to take action for income tax deduction this year.

See you!

From year 2021, refund process was changed. Now revenue department sends you check so that you can encash in any banks in Thailand

Comment