Recently, Thai government announced shopping program which has benefit for general consumer to enjoy the benefit of tax payer in Thailand (In Thai, this program is called “Shop Dee Mee Kuen”). This program is valid from January 1st to February 15th, 2022. If you have any plan to purchase goods or service during this period, please do not forget to join this program to get income tax refund.

Announcement excerpt from Thai government

Under the Shop and Refund program, a tax deduction of 30,000 baht will be offered to shoppers spending at VAT-registered stores from 1 January to 15 February 2022.

General Guidance

This program is to encourage expenditure on commodity goods to stimulate economy in Thailand. Good purchased amount up to 30,000 THB, you can use as deductible amount from your taxable income for year 2022 contribute to your tax refund in 2023.

Below is the income tax rate applicable to each level of income amount. In case, you utilize this program fully with 30,000 THB shopping and your taxable income amount is 1,000,000 THB, calculation will be as below.

First, 100,000THB basic deductible and 60,000 THB for tax payer deductible will be applied as a condition. Therefore your taxable income will be 840,000 THB (1,000,000 – 100,000 – 60,000)

After that you can deduct 30,000 THB from taxable income amount 84,000 THB. You can reduce taxable amount by 30,000THB applied to 20% tax rate in below table so you can get tax return, 6,000 THB (20% of 30,000 THB). This is just example for the calculation of tax refund amount. Tax refund amount you can receive is depends on your income and deductible amount of course.

| Taxable income | rate | Applicable tax (max) | Accumulated tax (max) |

| 0~150,000 | exempt | 0 | 0 |

| 150,000~300,000 | 5% | 7,500 | 7,500 |

| 300,000~500,000 | 10% | 20,000 | 27,500 |

| 500,000~750,000 | 15% | 37,500 | 65,000 |

| 750,000~1,000,000 | 20% | 50,000 | 115,000 |

| 1,000,000~2,000,000 | 25% | 250,000 | 365,000 |

| 2,000,000~5,000,000 | 30% | 900,000 | 1,265,000 |

| 5,000,000~ | 35% |

Applicable goods

You can purchase VAT inclusive goods or service up to 30,000 THB. However below items cannot used for tax refund item so please be careful.

Items cannot be used for tax refund

- Alcohol and cigarette

- Cars, motor bikes and gasoline

- Utility fee such as water, electricity and internet

- Newspaper and Magazine (Except books)

- Travel fee such as hotel accommodation, airplane ticket

- Medical treatment

Purchasing Period

Purchase must be made from 1st January to 15th February 2022.

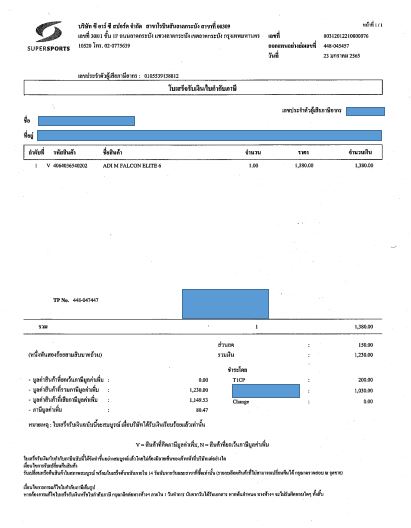

Process to get Tax invoice

Whenever purchasing goods, you must request shop to get Tax invoice document which mentions your name, address and TAX ID number same as your TAX ID card, In some store, for example, Robinson department, shop clerk asked me to show passport. Luckily, I brought on this day so there was not problem to get tax invoice. I advise to readers to bring passport to shop in case you are asked.

If you do not know your TAX ID number, you can ask payroll staff in your company.

Sample of TAX invoice document when I purchased Sneaker at Supersports. Kindly check your name, address and TAX invoice information is correct.

Tax refund process

With TAX invoice document, you can request TAX refund when you declare your income for 2022. Application period shall fall on January to March, 2023.

Every year, I explain step by step for income declaration and tax refund process here. Next year also, I will show you in this blog so you can refer it.

Purchasing deadline is near in i2 weeks! Enjoy shopping then get refund wisely.

Comment