hello, everyone, today I would like to make a post about my payday activity in Thailand. I know everyone loves payday because you will receive the reward from the company in return of your commitment to the work.

It depends on what you do of course after you receive certain amount of money. You may want to buy gift for you or fancy dinner with family. In my case, I have consistent habit of what I do on payday so this time, I will introduce it.

What is the F.I.R.E.

Before talking about my activity, please remember that I am looking for F.I.R.E. in near future. F.I.R.E. means “Financial Independent and Retire Early”. This idea of life style becomes more and more getting attention from younger generation to let them think to live differently from the traditional way, like you work in a company until your retirement age.

Before talking about my activity, please remember that I am looking for F.I.R.E. in near future. F.I.R.E. means “Financial Independent and Retire Early”. This idea of life style becomes more and more getting attention from younger generation to let them think to live differently from the traditional way, like you work in a company until your retirement age.

Normally we, company employee, devote our time and ability to work as full time employee then get money for living. In this state, we are not financially independent nor free from employment of course because we highly rely on the salary from the company to live.

To free from this bondage, F.I.R.E advises to save money as much as possible from your daily lives then invest to index fund to receive dividend or capital gain. Once you achieved to invest certain amount then get return which overweigh your standard living cost, you can be financially independent.

Wether you continue to work or not, you can sustain your life by the income from the fund. At this point you achieved F.I.R.E, financially independence.

Let’s say my standard expense for a month is around 25,000THB so yearly cost becomes 300,000THB. To cover all cost by investment, I must invest 6,000,000THB for index fund which expects 5% yield every year. Therefore now I invest my money to index fund S&P500 which fluctuates the values based on 500 top companies in U.S.

My payday activity for F.I.R.E

Every 28th of the month, I receive my salary from the company. I always withdraw all money from my payroll account then use or deposit in other bank.

Here is the deal.

First, I settle all payment for rent, utility bills and credit card statement. I will make another article for my living cost so you can get further ideas for this. Normally I pay 7,000THB for rent & utilities and 13,000THB on average for credit card every month.

Saving Money

Saving money is actually not a payday activity but daily awareness is necessary for you to wisely spend your money for what you really need. To know your expenditure, I recommend you take notes of what you spend in a month so you can consider to remove some unnecessary expense for next month.

In my case, before, I was buying all my food for readymade such as from Seven Eleven or Restaurants. After I abolish this habit then started to cook by myself I realized it is not only good for health by controlling ingredients but I can save cost for food also. I eat chicken breast a lot every day for protein intake. Before, I pay 40THB for 100g only in Seven Eleven but now I purchase raw chicken 1kg for 100THB only for my cook. Now my cost for chicken breast was reduced 75% by my cooking.

This is one example of saving cost. You can also look back on your spending habit then review to reduce unnecessary cost.

And on payday, I withdraw 5,000THB for cash payment use. This amount is for transportation, restaurant for cash and family Mart shopping and other use whenever cash payment is required. In case I didn’t use up the amount, I keep such petty cash then withdraw money on next payday so the cash deposit will reach 5,000THB. This month June 2021, I left 400THB so I withdrew 4,600THB only.

Investment and deposit

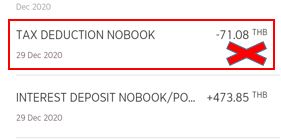

Ok, so far I spent 25,000THB in total. Next I will purchase mutual fund around 40,000 THB every month. The main purpose is to save income tax when declaring withholding tax and to get dividend and capital gain as auxiliary benefit. My target mutual fund for investment is SCBS&P500-SSF and SCBRMS&P500, both for index fund of S&P500.

Rest of amount from the salary, I keep in the SCB EZ saving account. This is online account with high interest rate 1.5% up to 2,000,000THB deposit per year. I keep supplement money for emergency purpose in this account. If you are interested, please inquire SCB bank through below link. Do not forget to bring and submit TAX ID card to exempt interest tax for your interest.

Go to SCB homepage for EZ savings account.

Conclusion

Ok, that’s all about my payday activity. Basically I do prefer simple life not extravagant one so I do not spend much money. Instead, I keep it for savings and investment to achieve financial independent, to get another source of income other than employment. I will update the progress for my F.I.R.E achievement occasionally in this blog.

Comment