Welcome back to fitravelife.com!

Before going back to Japan in May 2025, I purchased new cell phone and requested VAT refund in the store so I would like to show VAT refund guide in Thailand for you.

What is VAT in Thailand?

VAT (Value added tax) is 7% government tax Only foreign tourists can enjoy this 7% tax refund on specific condition as explained below.

Who is eligible for VAT refund

VAT refund is eligible only for foreign tourists not living in Thailand. That means Thai national or foreigners working or studying in Thailand cannot use this scheme, sorry! Commodity goods you purchase must be at least 2,000 baht in same store on same day. Then you have to bring goods out of country within 60 days from purchased date.

- Only foreigners not living in Thailand

- Good(s) more than 2,000 baht at one time purchase

- Bring goods our from the country 60 days from purchase

- Exit from International airport only

International airports are 10. Suvarnabhumi, Don Mueang, U-Tapao, Chinag mai, Chiang rai, Hatyai, Phuket, Samui, Surat Thani and Krabi.

Steps for VAT refund

1.Purchase good at registered store

Before you purchase the goods at store, you definitely confirm with shop store if they can produce documents for VAT refund. Please check official sticker if store is registered as VAT refund shop

I purchased cell phone at the shop in Central World where many tourists come and shop so staff here are well known about procedure. For documentations, you need to bring passport of course. Refund amount will be 450 THB for 9,999 THB product purchase.

My new cell phone comes with many freebies, hahaha

2.Receive document P.P.10 form and Tax invoice

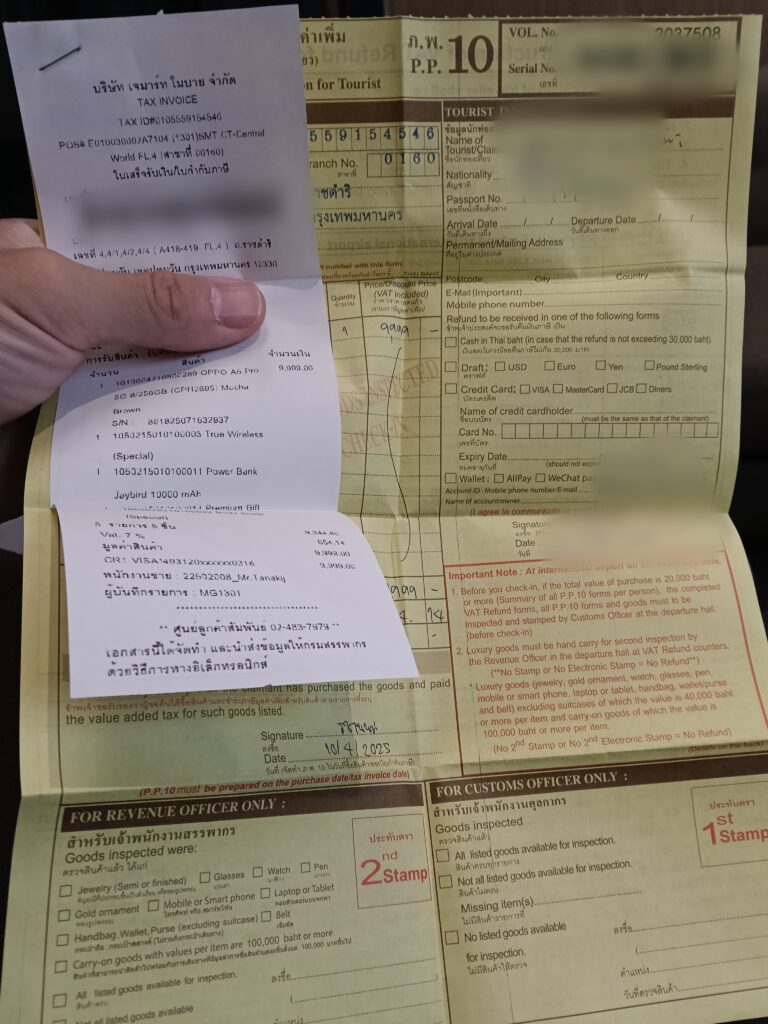

Upon purchasing goods and showing your passport, staff will prepare for Tax refund form (P.P.10) and Tax invoice under your name. Both documents are necessary to request refund at the airport.

P.P.10 form and tax Invoice

3.Product inspection at international airport before check-in

In case your purchase amount is more than 20,000 THB, you need to show your goods and get stamped on P.P.10 form by custom officer before check-in at the airport. In my case, not more than 20,000 THB, this procedure is not necessary.

4.Receive refund amount after passport control

You can get VAT refund amount at Tourists office by submitting P.P.10 form and tax invoice. In case your purchased goods are luxury stuff more than 40,000 THB, officer requires you to show the goods again at this point.

Refund amount will be paid in cash for less than 30,000 THB. If more, you can choose e-wallet or credit and debit card return only with fee. Processing fee costs 100 THB in any case and a bit more for e-wallet and card process.

I will update my refund process experience when I exit the country.

See ya!

Comment