Welcome back to my blog!, Today, I would like to explain how to declare your income in Thailand online for year 2021. Surprisingly, tax office renewed application site design this year so I will make step by step process here again for year 2021. Basically what you need to do is same you have to input information from withholding slip then input and submit your deductibles. After that system will calculate tax amount on you. In case you overpaid through a year, you are entitled to refund. If you underpaid, you are required to pay extra tax nearby banks.

Who should file an application?

If you are working in Thailand as company employee same as me, of course, you need to pay as mandatory. This process is necessary for all people, either Thai or foreigners in Thailand As long as you have source of income in Thailand, you must do it. Even if you are not employed in Thailand, your period to reside in Thailand counts more than 180 days in a year, in such case you also have to declare your income by this process.

Submission deadline

Income throughout year 2021 must be declared from January 1st to March 31st, 2022. In this page, I will explain how to submit online. Although you can also submit in person at nearby tax office, I recommend here to submit information and document by online which is much faster and convenient, more importantly easy.

Below is the processing for last year. unfortunately system design was changed so no longer can be referred.

Document to prepare

- Por Ngor Dor1

- Dependents identification

- Proof for deductible items (if any.)

Online submission process

Access and login application page

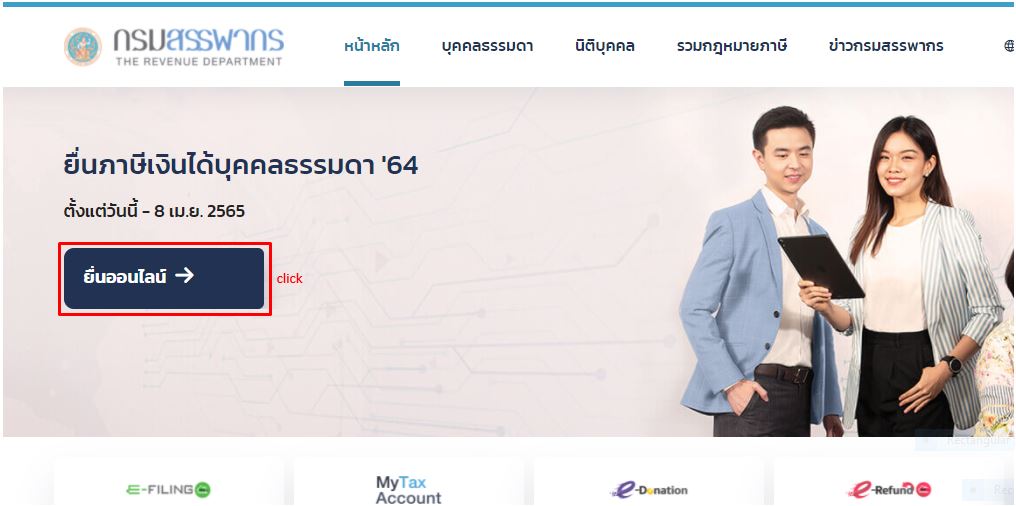

Access below link Tax office homepage

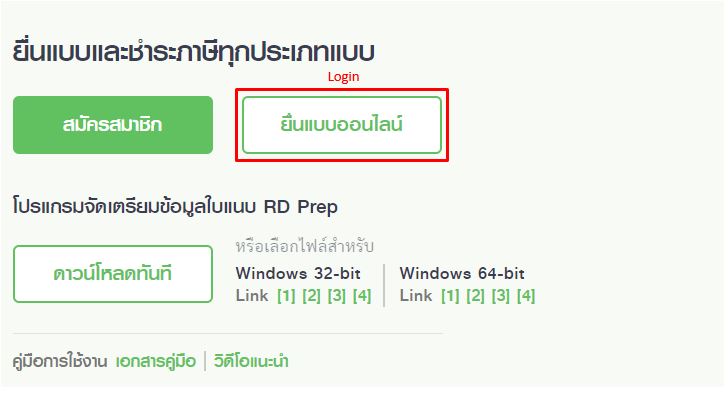

Click to log in your unique page to submit application.

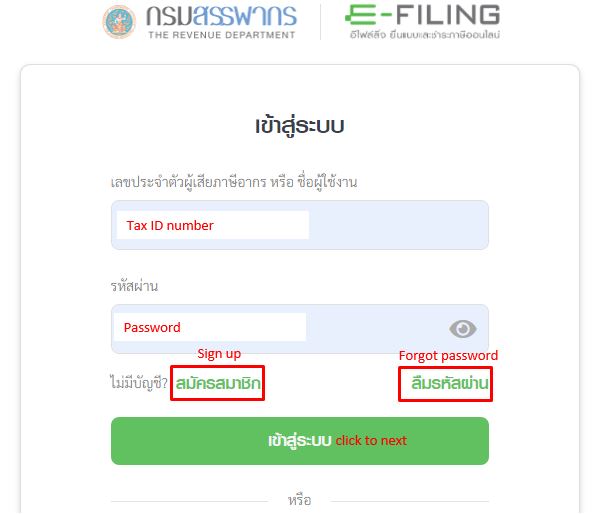

To log in application page, you have to input tax ID number (13 digit) and password you designated when making account. For first timer, please sign up first to make your account.

One time password will be sent to your registered mobile phone to verify the access.

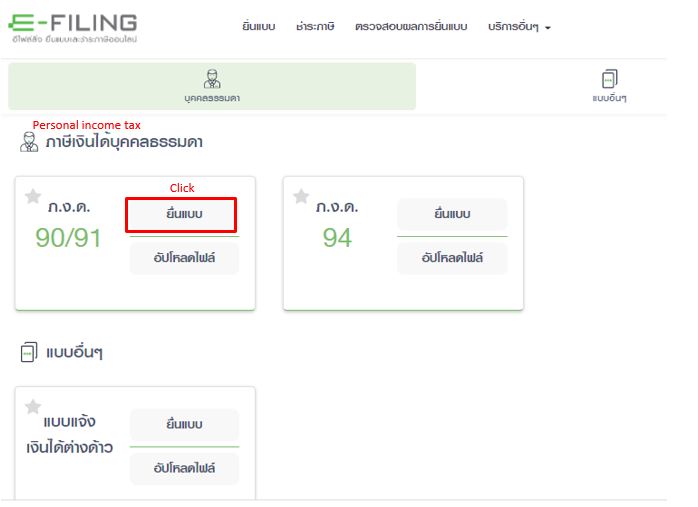

Proceed to application page from menu screen below.

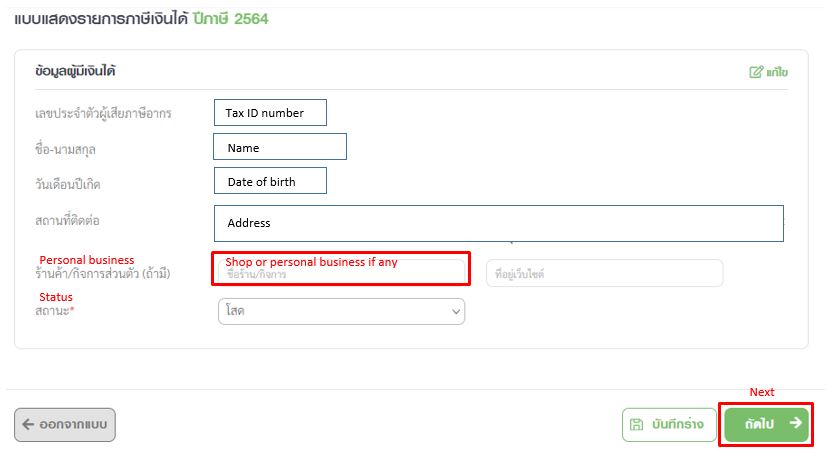

Confirm tax payer information

Your basic information such as Tax ID, name, date of birth and address will appear on the screen. In this page, marital status must be selected which impacts on your tax deduction amount.

For marital status, please refer to below then select most suitable one.

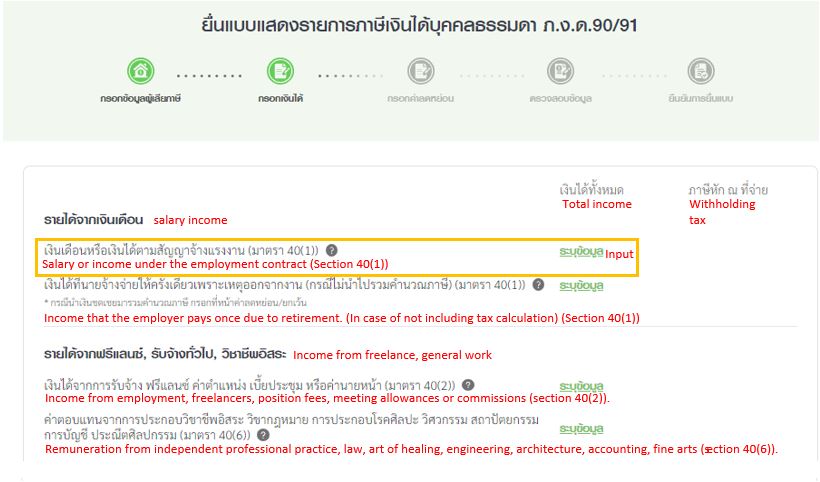

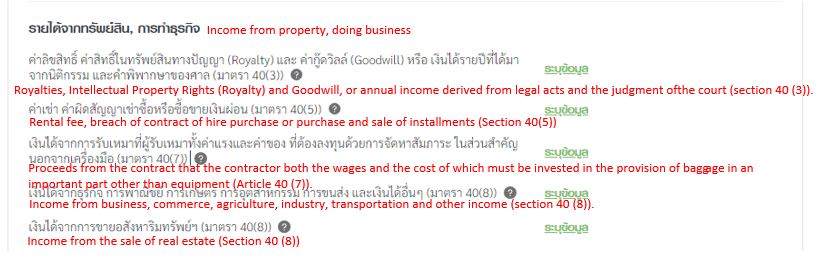

Input income and withhold tax information

From this page, you have to input your income and withhold tax information. For most people like me as company employee, you have to input your annual income and withholding tax in below yellow highlighted field, Section 40(1).

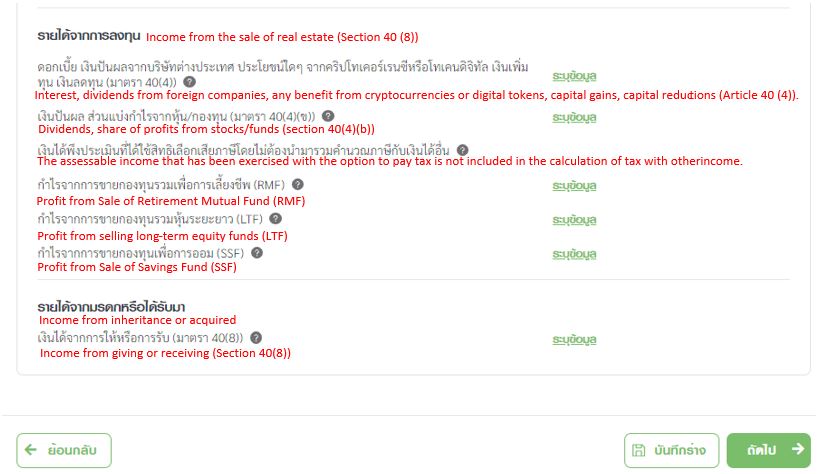

in case you have income source other than employment, please select such item then input necessary information. For me I have income also from my mutual fund as dividend. I will explain how to input dividend amount later on.

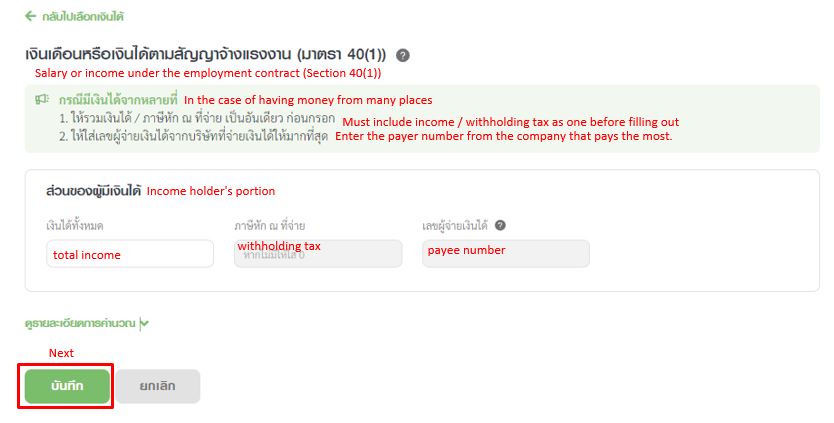

This is the page to input your salary income and withhold tax under employment. If you already receive withholding slip “Por Ngor Dor1” document from HR, you can refer to it to input the numbers. Tax ID of the organization you belongs is also needed to input in this page.

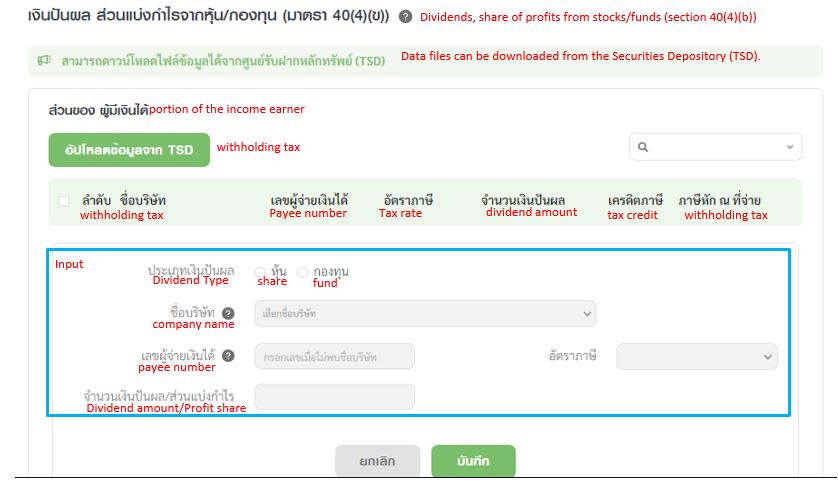

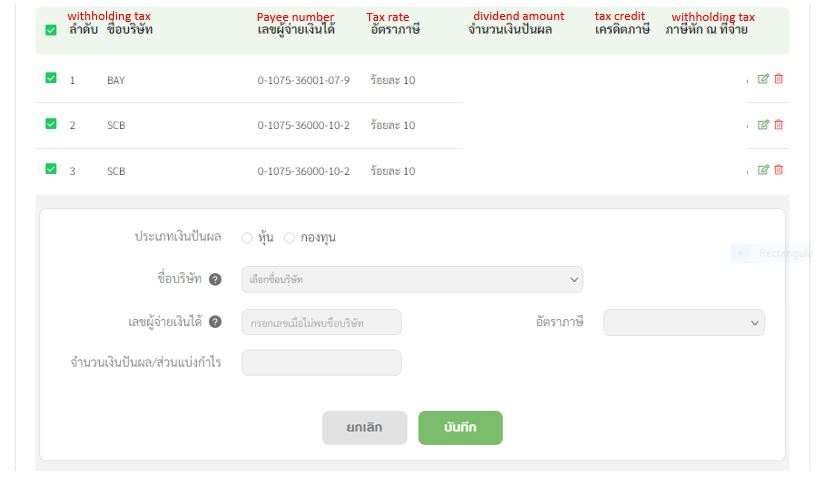

Next, is the step to input income as dividend from my stock. Please click Dividends, share of profit from stocks/funds on list page then move to individual input section as below.

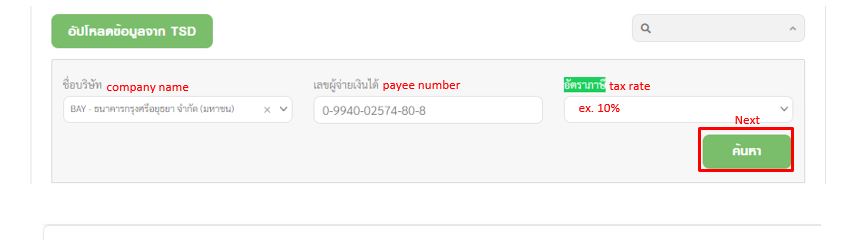

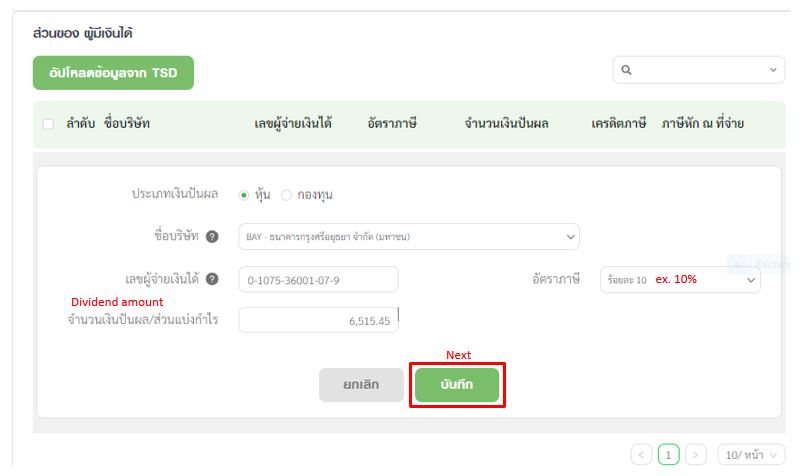

For input, please fill in the field, framed by blue line. First, select dividend type share of fund. Then, select company name for transaction, tax rate and amount of dividend. To input correct information, you better ask for the banks or your contracted fund to get certificate to prove the amount. Such document must be attached in the application later so you must have it at the application phase.

Payee number is automatically filled in by the system.

Make sure that your dividend history is recorded correctly in the list below.

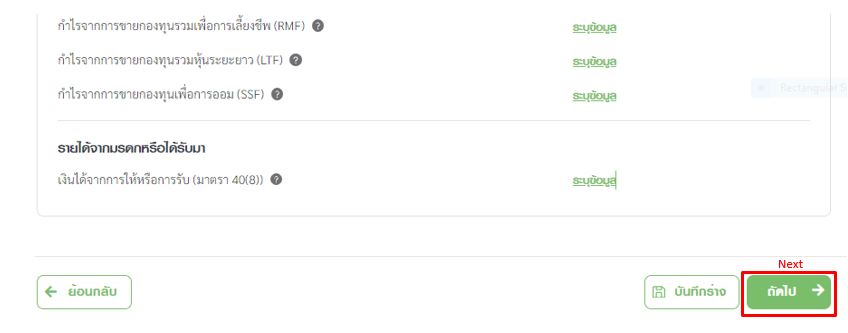

For me, I already completed making input for my income and withhold tax. Once done your part, go click next to proceed to the page for deductible items.

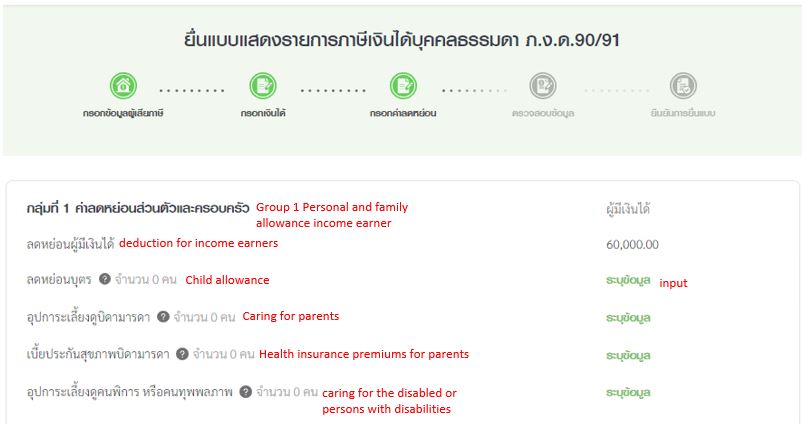

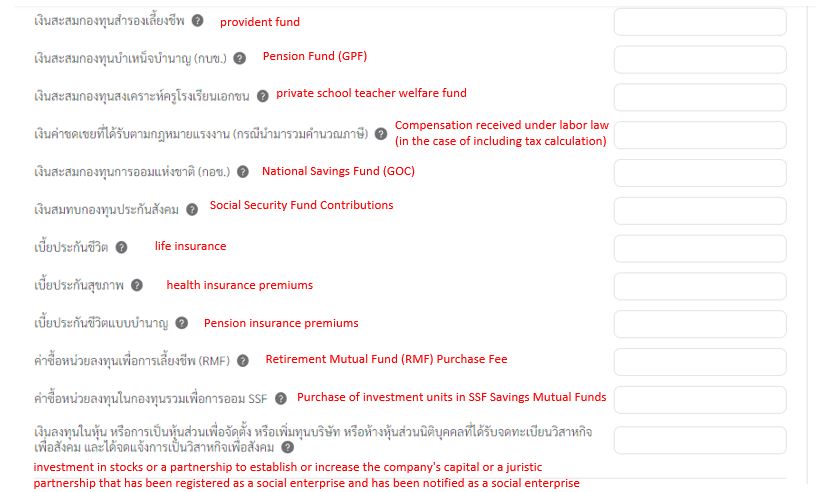

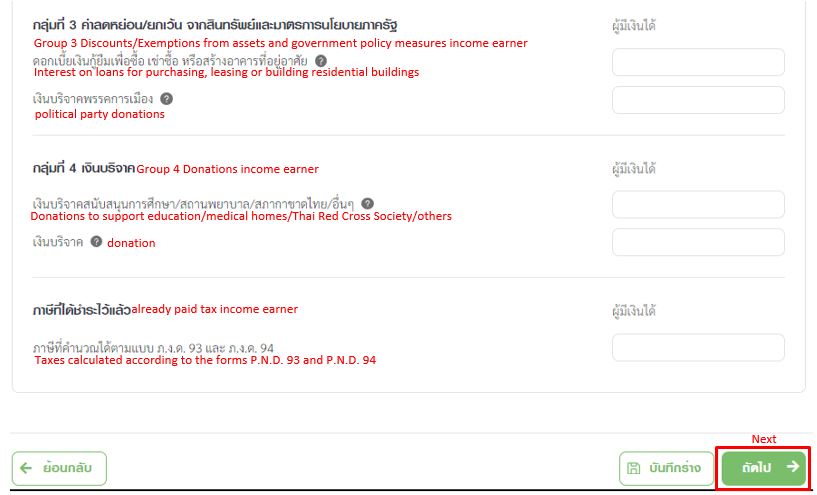

Input deductible item

In next page, you are requited to input your deduction item on the application.

As first step, you can add your dependent family information. I am single and living in Thailand alone so nothing to input in this step. Applicable deductible amount is only 60,000 THB for myself.

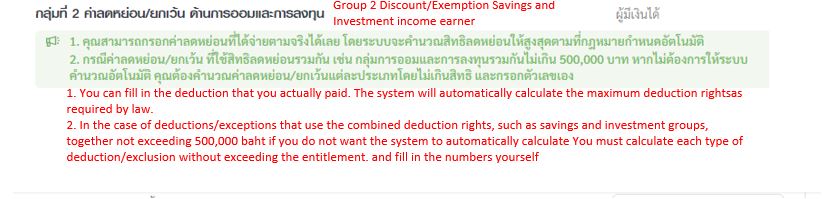

After that, you can add various deductible items in the system if applicable such as health insurance premium, mutual fund and donation etc. In my case, I purchase health insurance from Thailife, SSF (Super saving fund) and RMF (Retirement mutual fund) from SCB (Siam commercial bank).

I wrote my income tax saving strategy before. You can also refer to this post for some idea.

Oh and not to forget, if you are typical company employee, you must pay social security fee every month, deducted from your salary. This total contribution amount can also be used as deductible item. Total amount you paid in one year, you can refer to “Por Ngor Dor1” document.

Click next after completing all deductible items input.

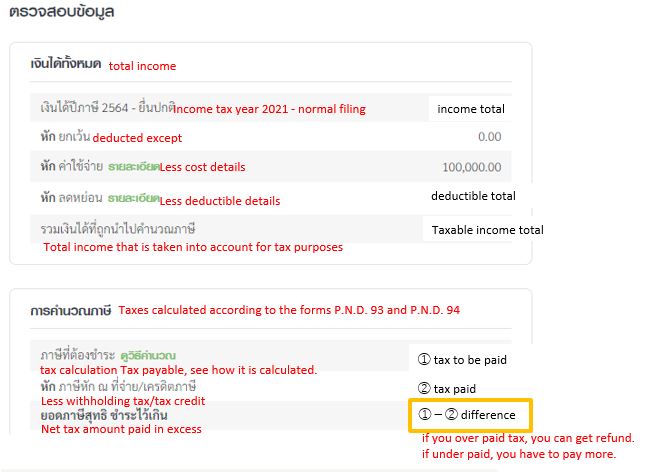

Confirm summary calculated by system

Once all necessary numerical items are filled in the application form, system will calculate then generate the summary. As a result of system calculation, if you paid too much tax, you can request refund. On the other hand, you might pay additional tax in case you pay less for your burden.

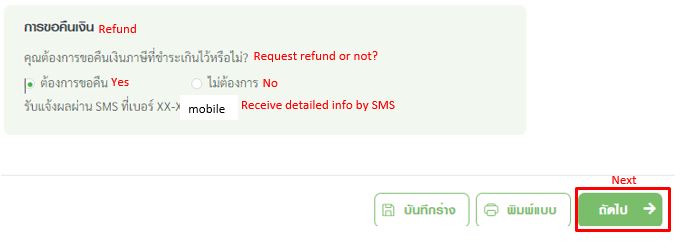

For refund, make sure to click “YES” to request refund then go to next page.

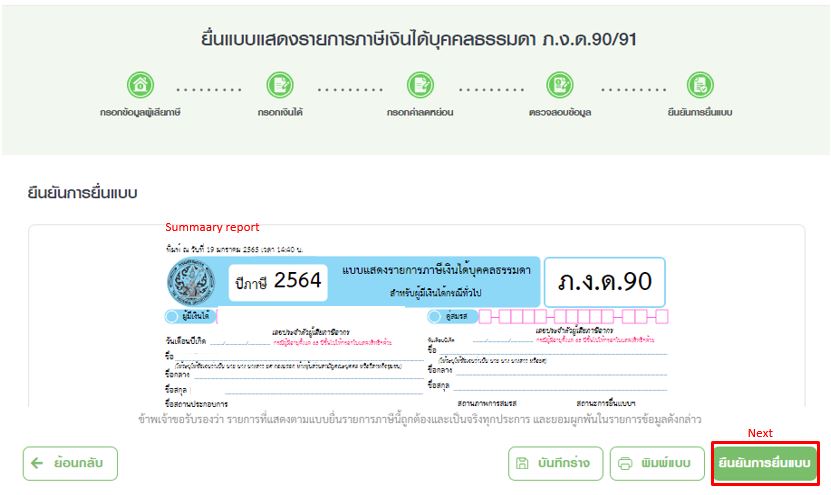

On next page, official summary report can be generated for your reference. You can save or print out this summary report.

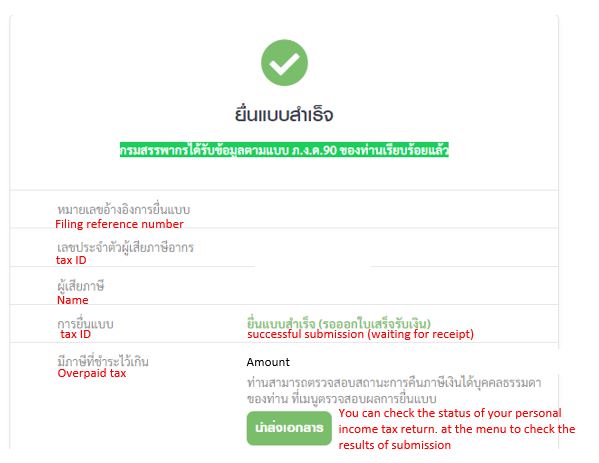

Confirmed your application was successfully done!

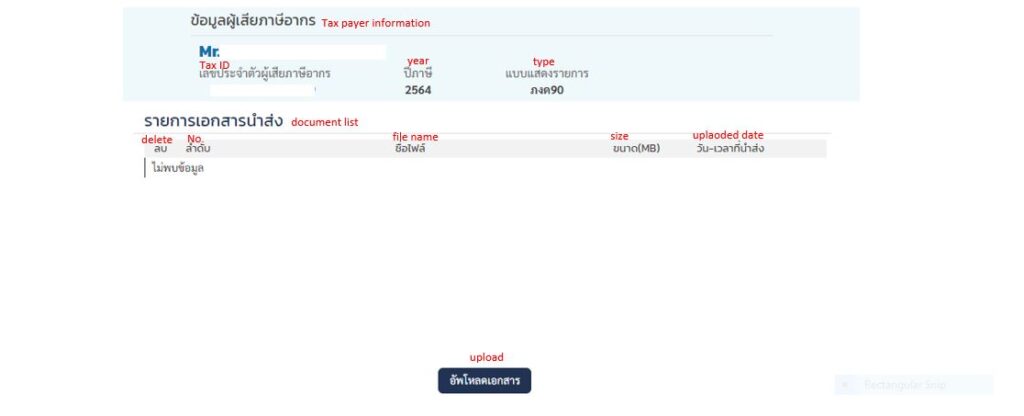

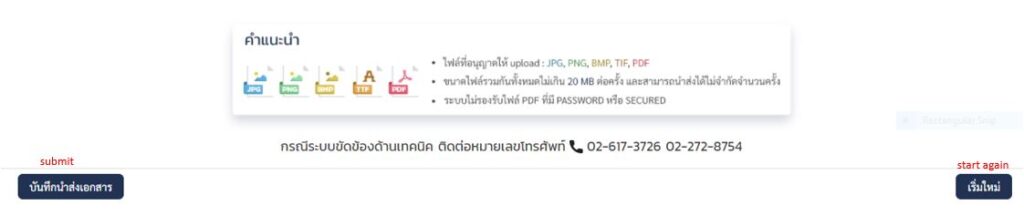

Submit supporting documents

Not only submitting online application but also you are required supporting document to verify the input you made. Unless you upload the all necessary documents, tax office cannot complete document check process.

Check processing status

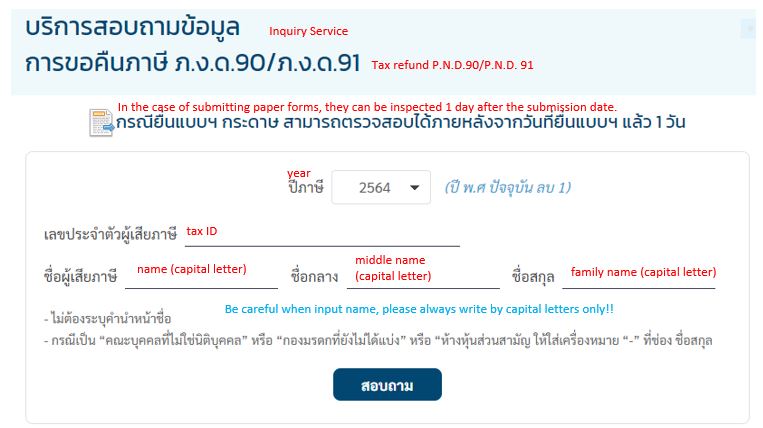

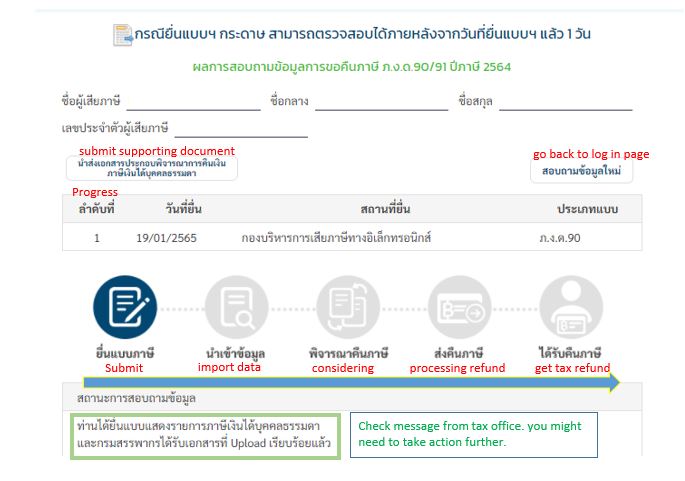

As long as you submit your online application, you can check the verification progress by tax office in below page.

In case you need to submit additional supporting document, you can submit form above page.

To log in the page, please input your TAX ID number and name. Be very careful that system can only acknowledge capital letter for the name.

Below is the screen of document check progress status. Please check sometimes then check the comment from tax office if they need any action from you to submit more information to verify the application.

Receiving Tax refund

This year, I just submitted application so I still need to wait for it to complete. Once processing is done, tax office will send notice letter to your registered address. With the document, you can get refund at the bank.

*I received document from tax office. For refund process, please refer below.

Comment