Welcome back to “fitravelife.com”.

This time, I would like to teach you how to exempt interest tax from your savings account in Thailand. Don’t be worried, this is completely legal way lol in Thailand.

To enjoy this benefit, you just need to submit your Tax ID card to your bank then you can save up to 3,500 THB for interest tax from your account.

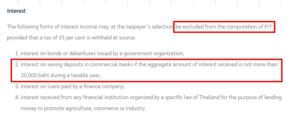

Interest tax in Thailand

Interest tax rate for bank saving account is 15% in Thailand

However, this interest tax up to 20,000THB of interest can be exempted. Therefore you can save 3,500THB interest tax at maximum up to 20,000 THB interest you earn from your savings in bank.

See below link by Revenue department.

For Thai people, this exemption will apply automatically but for foreigners like me, we have to submit Tax ID card to the bank and agree that the bank may disclose our information to the revenue department to get interest tax exempt benefit.

This submission process is necessary because Tax ID number for Thai people is linked to their national ID number while not for foreigners.

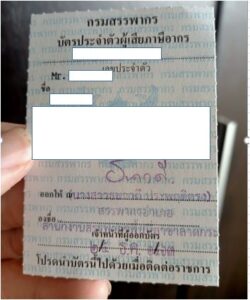

Tax ID card

Some of you might not know what Tax ID card in Thailand. TAX ID card is actually a small paper strip that states your Tax ID number, name and registered address.

If you do not have this, you can ask HR in your company. The company might keep it when they get your Tax ID number to register your information first time at Revenue department.

Tax ID card (paper strip)

In case you lost such document or cannot find it, you can go to nearby tax office then ask for reissuance free of charge. You need to bring below documents together with you to tax office.

- Passport

- Work permit

- Document shows your tax ID number (Por Ngor Dor1, any documents from Revenue department)

Submit Tax ID card to Bank

Once you get Tax ID card, you head to your bank with Tax ID card, passport and Bank passbook (if any). Once bank’s process is complete, you will be exempted for interest tax up to 20,000THB.

If you have account more than one account, you need to submit above documents to all banks where you have saving account.

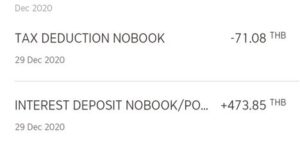

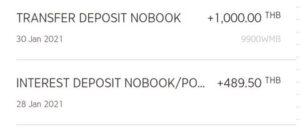

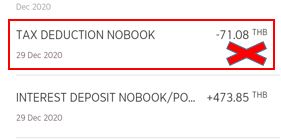

Below is my saving account history before and after submitting Tax ID to the bank. You can see that there is no longer 15% tax deduction for interest.

Before submitting Tax ID card. There is deduction 15%.

After submitting Tax ID card. There is no more deduction.

OK! That’s all for today. By this simple step, you can save up to 3,500 THB per year, which amount will be charged as interest tax from interest earned for savings account in Thailand.

And one more thing to addition in the last, interest tax you already paid can be refunded in current tax year only. If you wish to get refund, please inquire to your bank so the bank staff shall give your withhold tax documents to process.

See ya!

Comment